Within your Snapshot Reports, you will notice 2 similar balance reports: Ledger Balances and Statement Balances. You may have also noticed that the two balances do not always equal. This can happen for a few different reasons. It is best to individually compare the Ledger Statement and Balance Statement for each client under Billing > Bill Client.

The difference between the Ledger Statment and Balance Statement

The Ledger Balance is an actual ledger (sum of payments and charges). The Statement Balance is the sum of charges that are billed to the client and the sum of the payments applied to those charges.

The main two differences between the two reports/statements (as far as why the balances may be different) are:

- The date of payments entered into Therabill.

- The session status (Open vs Closed).

The client balance statement can also account for open/closed sessions. For information on what a closed session is, please see: Session Status.

Client Ledger Balance/Statement

The ledger statement resembles a checkbook. Entries (charges and payments) are entered in the order that they occur. You will see all charges regardless of their session status.

- Charges - The date listed is the Date of Service

- Payments - The date listed is the Post Date

Statement Balances (Client Balance Statement)

The client balance statement lists Dates of Service (charges) that are billable to the client and the balance due on those sessions. Each line represents a procedure/service and shows the sum of all payments and adjustments. The balance due is equal to the charge minus the payments and adjustments. Because all payments and adjustments are summarized for each charge, the effective date of the payments and adjustments is the Date of Service.

- Charges - The date listed is the Date of Service

- Payment - The payment reflects the Date of Service it is applied to

An open session means that you are awaiting adjudication from the insurance. A closed session means that the remaining balance is due by the client. For more information, please see: Session Status

What statement should I use?

Both statements have a use. The Client Balance Statement is recommended for billing your clients because it takes into consideration sessions that are still pending insurance. The Ledger Statement is great if your client wants a breakdown of the charges, payments, and the dates they happened. Just be sure that your clients know that the balance of this statement is not necessarily what they owe.

Why have two different types of balances?

Having both balances provides you with a great tool for reconciling and catching discrepancies in your patient balances, especially if you are using the Client Balance Statement for billing your client. It allows you to catch differences between the client's ledger and the statement balance you are giving them. If you notice a difference between the two, it gives you an indication that you may want to reconcile that account to find out why the balances are different.

So, why are the client balances different?

There are four main reasons why the balances will not equal. These reasons are outlined below.

TIME-SAVING TIP: The first two reasons may be due to data entry mistakes by your clinic and can easily be spotted within your clinic's ledger found at Schedule > Ledger.

Reason 1: Payments applied to sessions that are not billable to the client

Therabill allows you to create session classes that indicate a session is not billable to a client. These sessions will not show up on a client balance statement. Therefore, the payments will not show up on the client balance statement. The charges for these sessions will not show up on a client ledger. However, if you applied payments to the session, the payments will show up in the client ledger.

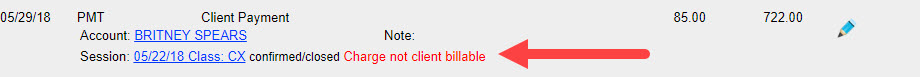

You can find payments that are applied to these sessions in your ledger. In your ledger, these payments will be listed with red text stating 'Charge not client billable'.

Reason 2: Payment was applied to service and the service was subsequently deleted

If you applied a payment to a service/CPT and then later delete the service/CPT, then the charge amount and the payment amount will no longer show up on the client statement. However, the payment will still be recorded in the ledger. Be sure to always delete/unassign payments associated with a service/CPT before deleting the service line.

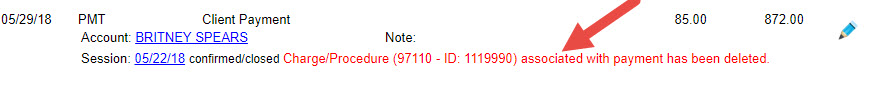

You can find payments that are applied to deleted charges in your ledger. In your ledger, these payments will be listed with red text stating that the charge was deleted.

Reason 3: The open/closed nature of the session/charge

This is probably the main reason for the two balances being different. The client balance statement is able to utilize the open/closed nature of the session. That is, the charge amount for sessions that are open to insurance are not reflected in the balance. The ledger statement shows all charges and payments, regardless of session status.

Reason 4: The effective date of the payment

It is probably easier to understand why the balances may differ due to the effective date of the payment by using a simple example. In this example, we are going to assume there is a single charge and a single payment applied to that charge. Let's say you have a charge/session of $100.00 with a date of service of 2/1/2018. You then applied a payment of $30.00 towards that charge on 2/15/2018.

In summary,

- Charge: Date of Service: 2/1/2018 and amount: $100.00

- Payment: Posted date (received date) of 2/15/2018

Now, we will go over two scenarios. The first scenario is if you were to create both a client balance statement and a ledger statement with an ending date of 2/15/2018. The second scenario is if you were to create both a client session balance and ledger balance report with an ending date between 2/1/2018 and 2/15/2018.

What do you mean by 'ending date'? If you are viewing balances in Snapshot Reports, then this is referring to the date entered into the filter area. If you are viewing a statement in Billing > Bill Client, then this is the ending date you supply using the date range at the top of the page.

Scenario 1: Ending date on or after the last payment date

In this example, assuming all sessions are closed, the two balances should equal. We will use an end date of 2/15/2018.

Client Balance Statement |

Ledger Statement |

||||||||

| Date | Charge | Payment | Balance | Date | Description | Charge | Payment | Balance | |

| 02/01/2018 | $100.00 | $30.00 | $70.00 | 02/01/2018 | service desc | $100.00 | $100.00 | ||

| 02/15/2018 | payment desc | $30.00 | $70.00 | ||||||

Scenario 2: Ending date in between the charge date and payment date.

In this example, the two balances will not be equal. We will use an end date of 2/10/2018. In the client balance statement, the payment of $30.00 will be included (because it takes on the Date of Service). In the ledger statement, the $30.00 payment (which takes on the post date of 2/15/2018) will not be accounted for.

Client Balance Statement |

Ledger Statement |

||||||||

| Date | Charge | Payment | Balance | Date | Description | Charge | Payment | Balance | |

| 02/01/2018 | $100.00 | $30.00 | $70.00 | 02/01/2018 | service desc | $100.00 | $100.00 | ||

Comments

0 comments

Article is closed for comments.