These reports provide information on session balances, client balances, and accounts receivable. Date of Service is the default filter for most of the reports in this category.

Note: Reports that have a Provider filter can only use providers that are currently in your Provider List.

Balance Aging Report

For a more detailed explanation of this report: Balance Aging Report.

The aging report gives you a summary of balances based on how old the balance is. The age of the balance is binned into groupings of 0-29 days old, 30-59 days old, 60-89 days old, 90-119 days old, and greater than 119 days old. You can view your claim aging by Insurance, Client, Provider, Insurance Plan Type, or Responsible Party. There is also an expand icon![]() associated with each row that will allow you to see the details of the balances within each row.

associated with each row that will allow you to see the details of the balances within each row.

Important: As with many reports in Therabill, this report requires that you accurately enter all payments and adjustments for authentic results.

Important: The grand total of all balanced when aged by Client does not always equal your total accounts receivable (A/R). For more information, please see: Aging Balance Does Not Equal Accounts Receivable.

Aging by Client or Responsible Party: Each row represents a client that has a balance. The bins are based on the Date of Service.

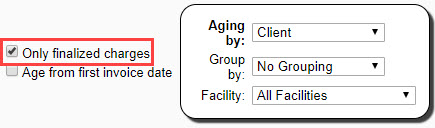

NOTE: The default view when aged by Client or Responsible Party will show the balance of all sessions. This is the balance of sessions that are both open (pending insurance) and closed (client due). You can use the checkbox filter to only view balances of sessions that are finalized/closed. This option will resemble the client balance due. For more information on open/closed sessions, please see: Session Status and Session Action.

Aging by Insurance: Each row is an insurance company that has sessions that are pending payment from them (the last insurance company you billed the session to). The aging of the balance is based on the date you billed the sessions to the payer. If you post payments from an insurance and create a claim to another payer (i.e. secondary insurance), the sessions will move to the most recent payer's grouping.

Monthly A/R

For more information, please see: Monthly Accounts Receivable (AR) Summary

The monthly summary report shows you the month-end accounts receivable (A/R) balances for a given date range, filtered by Service Date or Posting Date range. In addition to the total balance due (A/R), Therabill displays the total charges, insurance payments posted, client payments posted, agency payments posted, and adjustments posted for each of the months. Your true A/R is found by viewing the report using Posting Date Range and ending with the current month/year.

The current month's A/R in this report is your total accounts receivable to date. Other reports that show balances due within Therabill may not add up to this value. Specifically, a lot of people look at the grand total of the Balance Aging Report and assume it is the current accounts receivable. While this is sometimes the case, it is not always true. For more information, please see: Aging Balance Does Not Equal Accounts Receivable.

Note: The Charges column is always pulled by Date of Service, regardless of other filters.

Daily A/R

This report follows the same specifications as the Monthly A/R report (see the last section). However, this report can be filtered on a daily basis versus the monthly filters of the Monthly A/R report.

Session Balance Breakdown

For more information, please see: Session Balances Report

This report lists all sessions along with a summary of payments/adjustments and the current service balance in a given date range. There are a variety of filters you can use to narrow down the sessions that you are viewing. The Group By drop-down can be used to group each session by the parameter of your choice. The balance due on a session is equal to the charge amount minus payments and adjustments. It also shows the current status of the session (Unconfirmed, Confirmed, Ins Open, Closed/Patient Due). All sessions will flow from WebPT as Confirmed for clients with an insurance. If a client is Self Pay, the session will flow over as Closed. For information on the status of the session, please see: Session Status

Note: If you believe a session is missing in Therabill, this report can be compared to WebPT's Billing Report to find any discrepancy.

Ledger Balances

This report will list out each of your clients and their current ledger balance. This balance is simply a sum of all charges minus payments and adjustments that you have entered. This report will allow you to give an As of Date. Therefore, you can view the ledger balance as of a past date (or even a future date, if you are entering charges into Therabill in advance).

NOTE: The client also has another balance called the Statement Balance (see next section). The balances do not always equal. For information on the difference between these two balances, please see: Ledger balances versus statement balance.

Statement Balances

This report will list out each of your clients along with their current statement balance. The statement balance is how much they owe based on finalized/closed session on the Client Balance Statement. This report will also show you the client's Unassigned Payments balance. The Balance column is calculated by subtracting the Unassigned Payments from the Session Balance.

To post unassigned payments to specific sessions, please see the following article: Unassigned Client Payments.

NOTE: The client also has another balance called the ledger balance (see the last section). The balances do not always equal. For information on the difference between these two balances, please see: Ledger balances versus statement balance.

Write-Off Balances

This report will list each client that has had a write-off balance amount. This balance is the total amount of write-offs that have occurred for the client. This will can also show a detailed list of write-off balances per per client, per DOS.

For more infromaion please see the following article: Account Write-Off Balances Report

Comments

0 comments

Article is closed for comments.