There are several reports that show the sum of balances due (which is often your Accounts Receivable). Two such reports are the Balance Aging Report and the Monthly A/R Report. Often times, you might view the grand total of the Balance Aging Report and assume it is your total Accounts Receivable. In general, your total Accounts Receivable should be taken from the Monthly A/R report using the current month in the date range. However, it is worthwhile to note the reasons why the sum of the balances from the Balance Aging Report may not equal your total A/R. Here are some circumstances that will make the two values different.

Balance Aging Type

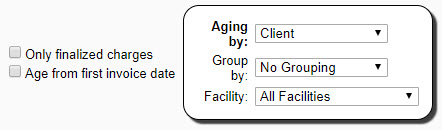

In general, the closest the Balance Aging Report will come to your total A/R is when you are Aging by Client and you are not only showing finalized charges.

- Aging by Insurance: If you are viewing claim aging by Insurance, then the Balance column will only display the balances open to insurance.

- Aging by Client (only showing finalized charges): If you are viewing aging by Client and you are only displaying finalized charges (closed/patient due), then the balances displayed will not be showing balances of sessions that are still open to insurance.

I am viewing claim Aging by Client and not just finalized charges, but the balance still does not equal my A/R.

The reason they are not equal is that the Balance Aging Report is based on sessions and the payments applied to them. Because this report only shows sessions with a balance greater than zero, the following two scenarios may cause discrepancies between your Balance Aging total and your actual Accounts Receivable.

- Unassigned payments: If you have entered Unassigned Payments then, by their nature, these types of payments are not assigned to a session. Therefore, they are not represented in this report. These unassigned payments are represented in your Monthly A/R when ran by Posting Date Range. You can see the total of all your unassigned client payments by looking at the Client Statement Balances report.

- Negative session balances: It is never a good idea to enter payments and adjustments on a session to the point that it will have a negative balance. A session should never have a negative balance. Some sessions may temporarily have a negative balance in cases of insurance overpayment. Negative balances are not displayed on the Balance Aging Report. However, they are represented in your Accounts Receivable.

So, how do I get my total Accounts Receivable?

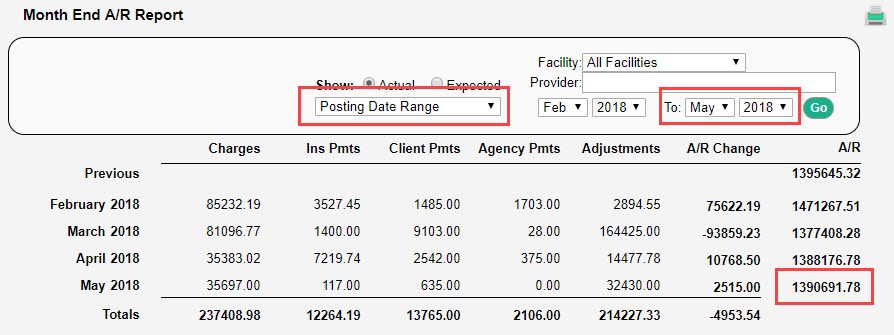

If you are wanting to know your current Accounts Receivable (total sum of all charges minus payments and adjustments) then use the Monthly A/R Report. Make sure you choose the To date as the current month/year and view by Posting Date Range. The total A/R listed for the current month will be your total A/R as of today's date.

Comments

0 comments

Article is closed for comments.