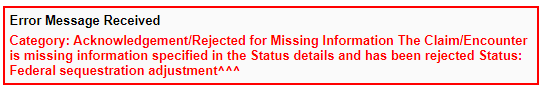

Medicare will provide the needed adjudication information when they submit a crossover claim to the payer on your behalf. You are receiving this rejection because the claim is missing a Federal Sequestration Adjustment amount (CO253) from Medicare’s claim consideration (835).

Note: Medicare applies a 2% sequestration reduction adjustment to all claim benefit payments. When electronically submitting a secondary (COB) claim on which Medicare has made a payment, the federal sequestration adjustment amount must be populated from the Medicare remittance using remark/reason code 253, in addition to all other Medicare payment and adjustment amounts.

Beginning on April 1, 2019, the AARP Supplemental Insurance Plans insured by UnitedHealthcare, electronic payer ID 36273, enforced a new plan-specific edit on all Medicare Supplement claim submissions. With this edit, a federal sequestration adjustment amount (CARC 253) must be included on all electronic claims submissions in which Medicare has made a benefit payment as a prior payer. AARP would like the claims to reflect the remark/reason code 253 separately.

Things to remember:

When Medicare does not crossover your claims to the AARP Medicare Supplement Plans, you will need to make sure this CO253 adjustment is applied before you electronically submit to AARP as a secondary payer. If Medicare is not forwarding claims, the client needs to update their Coordination Of Benefits (COB) with Medicare.

Things to double-check:

This rejection is also sometimes received in error. If Medicare has already crossed over the claim, and somehow it was also submitted to AARP again out of Therabill, you would receive this rejection. We recommend confirming with AARP that they are processing the Medicare claim that was submitted. This rejection can be ignored as long as you confirm the claim is being processed.

How To Fix

If the rejection was not received in error, use the following steps to fix the claim.

1) Locating the Adjustment Information

- Open the Medicare ERA from however you are most comfortable doing so. You can click on the session itself from the EDI rejection page and select the “View on ERA” link in the Session History Box, or go to Filling > EOB/ERA.

- At the top-right of the ERA, click Print, then select Remittance Advice.

Important: You will need the adjustment information from the PDF page that opens, so please keep it minimized for reference or print it out. The adjustments needed are listed in the StatGroup column of the Remittance Advice.

2. Locating the Session

- Go to Payments > Enter Payment > Single Session.

- Search for the client's name and the specific date of service in question.

- Click the black dollar sign

for the desired date of service to open the Session Information screen.

for the desired date of service to open the Session Information screen.

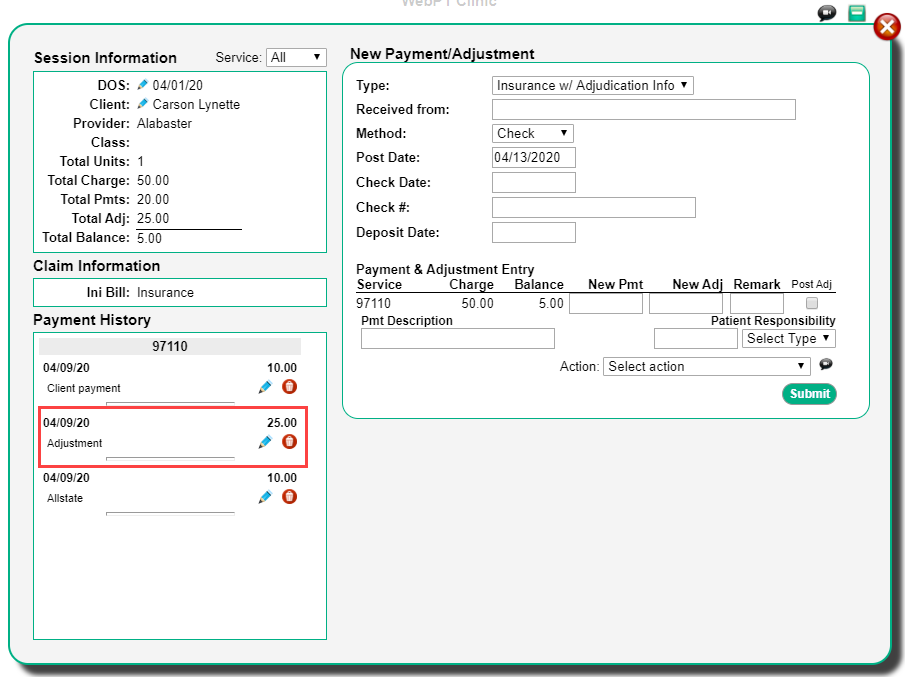

3. Session Information Screen:

Since the Medicare adjustment has already been posted, in the Payment History section at the bottom-left use one of the two methods:

Method A

- Delete the original adjustment amount by clicking the red trash can

.

. - You will then repost the two adjustments CO45 & CO253 separately on the same CPT code line.

Method B

- Edit the previously posted adjustment by clicking the blue pencil

.

. - Subtract the sequestration adjustment amount from the original adjustment that was posted and save the new amount.

- You would then post the CO253 amount as a separate adjustment on the same CPT code line

4. Posting the Adjustment (Method A or B):

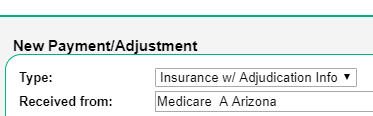

When you are posting the adjustments on the right-hand side of the screen, ensure your “Type” is listed as Insurance w/ Adjudication Info. You also want to enter in the primary insurance name in the Received From field.

Note: You do not have to complete the other fields in that section unless you would like to.

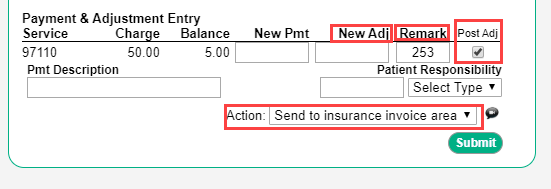

You will now complete the New Adj, Remark, Post Adj, and Action fields in the Payments & Adjustment Entry section.

Important: If you are choosing Method A, you must enter in one adjustment at a time.

- Enter in the adjustment amount in the New Adj column/box.

- Type in and select the adjustment remark/reason code

- Select the Post Adj checkbox

- Choose the “Send to Insurance Invoice Area” action

- Click “Submit”.

You will now be able to resend the claim electronically to AARP as the secondary payer from the Insurance Invoicing Area. DO NOT resubmit the claim from the EDI Rejection screen.

Comments

0 comments

Please sign in to leave a comment.