The Therabill Account Health/Healthcheck series is designed to help you get the most out of Therabill by staying on top of crucial workflows.

What?

Stay on top of your unpaid claims by reviewing your Balance Aging Report monthly. The majority of your insurance claims should be between 0 and 60 days old. Claims over 90 days old should be limited.

We recommend having less than 25% of claims over 90 days old.

Why?

This report shows the claims awaiting insurance payment. By keeping your visits aged 90+ days below 25% (an industry standard) you can be assured that whoever is working claims follow-up is doing a great job at getting those visits resolved (aka paid).

Note: If you have a large mix of Workers Comp, Department of Labor, or other payers with long payment processing timelines, your AR over 90 may be higher than 25% and that is okay.

How Often?

We recommend reviewing this report Monthly as part of your month-end processes as shown in our workflow guide.

Where?

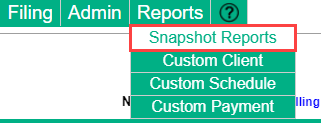

- Hover over the Reports menu and choose Snapshot Reports.

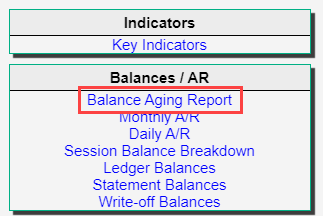

- Open the Balancing Aging Report.

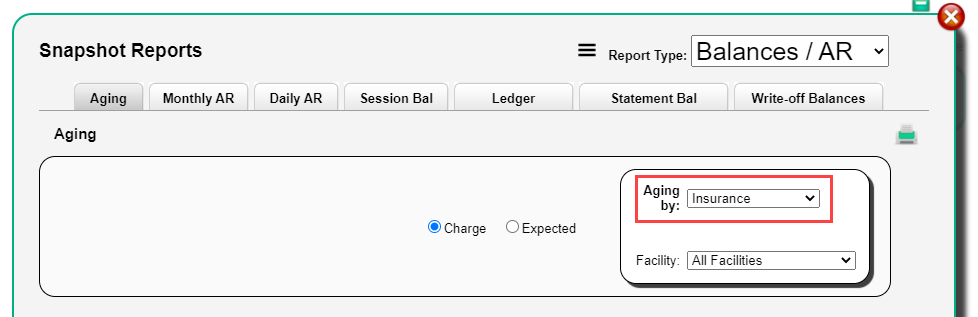

- Because we are examining unpaid claims open to insurance, we’ll use the Aging by: Insurance option.

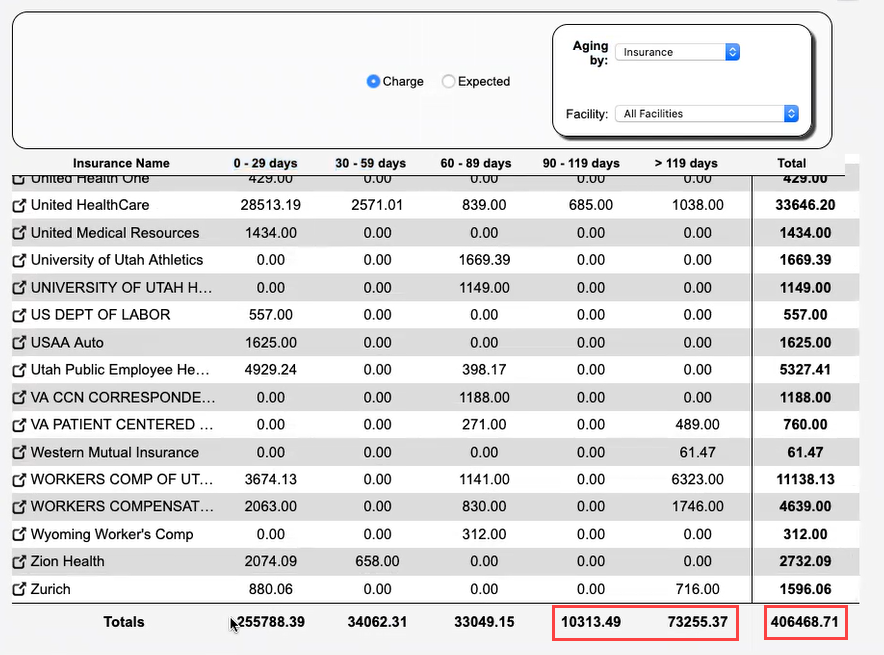

- Here, we will compare the total unpaid claims aged 90+ days to the total outstanding balance.

- To do this, we’d add the 90-119 days total to the >119 days column total and then divide by the total balance and multiply by 100. Remember, our goal is for this number to be less than 25%.

Formula [ (90-119 days total + >119 days total) / Total ] x 100

So using the data shown above and the formula, we will add [10313.49 + 73255.37] and then divide by 406468.71. This equals .206. Next, multiply .206 x 100 = 20.6%.

Comments

0 comments

Please sign in to leave a comment.