When billing insurance, your charge amount for a service code should be consistent across all payers. In reality, you usually do not receive reimbursement for your full charge amount. This means that your Accounts Receivable is inflated. That is, it is not actually what you expect to receive. Wouldn't it be nice if you could view a version of your A/R that is closer to what you expect to receive? Well, you can with Expected Rates.

For an example of the difference between expected rates and your charge amount, please see: Charge Amount vs Expected Rate

Entering an Expected Rate

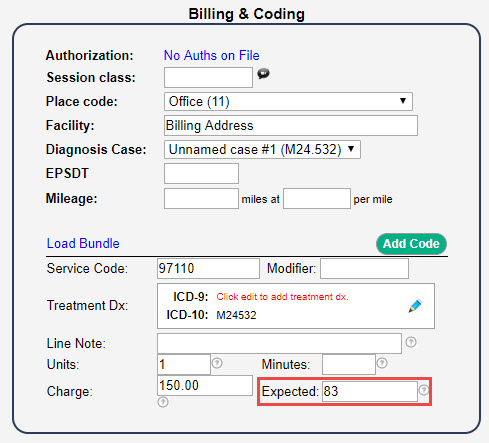

The expected amount for each of your service lines can be entered directly into the add/edit session form under the Billing & Coding section. You will see the Charge amount and the Expected amount.

Similar to the CPT Fee Schedule, which calculates the charge amount for you, you can also enter an Expected Rates schedule.

For instructions on how to enter an expected rates schedule, please see: Expected Rates Schedule.

What if I do not enter an Expected Rate?

If you do not enter an expected amount, the system will assume the expected amount is the same as the charge amount.

What do Expected Rates do for me?

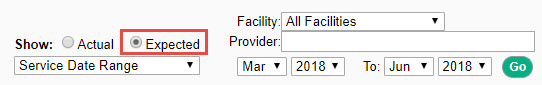

Using Snapshot Reports, you can have a more realistic look at your Monthly A/R, Daily A/R, and Balance Aging Report using Expedited Rates. Each of these reports has an Expected filter that you can select.

Another great use of Expected Rates is CPT Auto-Ordering. This is useful if you have payers that reimburse on a sliding scale.

Comments

0 comments

Article is closed for comments.